Net farm income is a broad measure of the profitability of a farming operation. It is calculated by subtracting the cost of production from the revenue generated by the sale of agricultural products.

Factors that can affect net farm income include the price of agricultural commodities, the cost of inputs such as seed, fertilizer, and fuel, and weather conditions that may impact crop yields. In recent years, net farm income has been volatile due to market fluctuations, trade disputes, and other economic factors. Ad hoc farm payments have helped stabilize the farm economy during these recent years. Other tools such as crop insurance, forward contracts, and hedging help mitigate some of the financial risks faced in production agriculture.

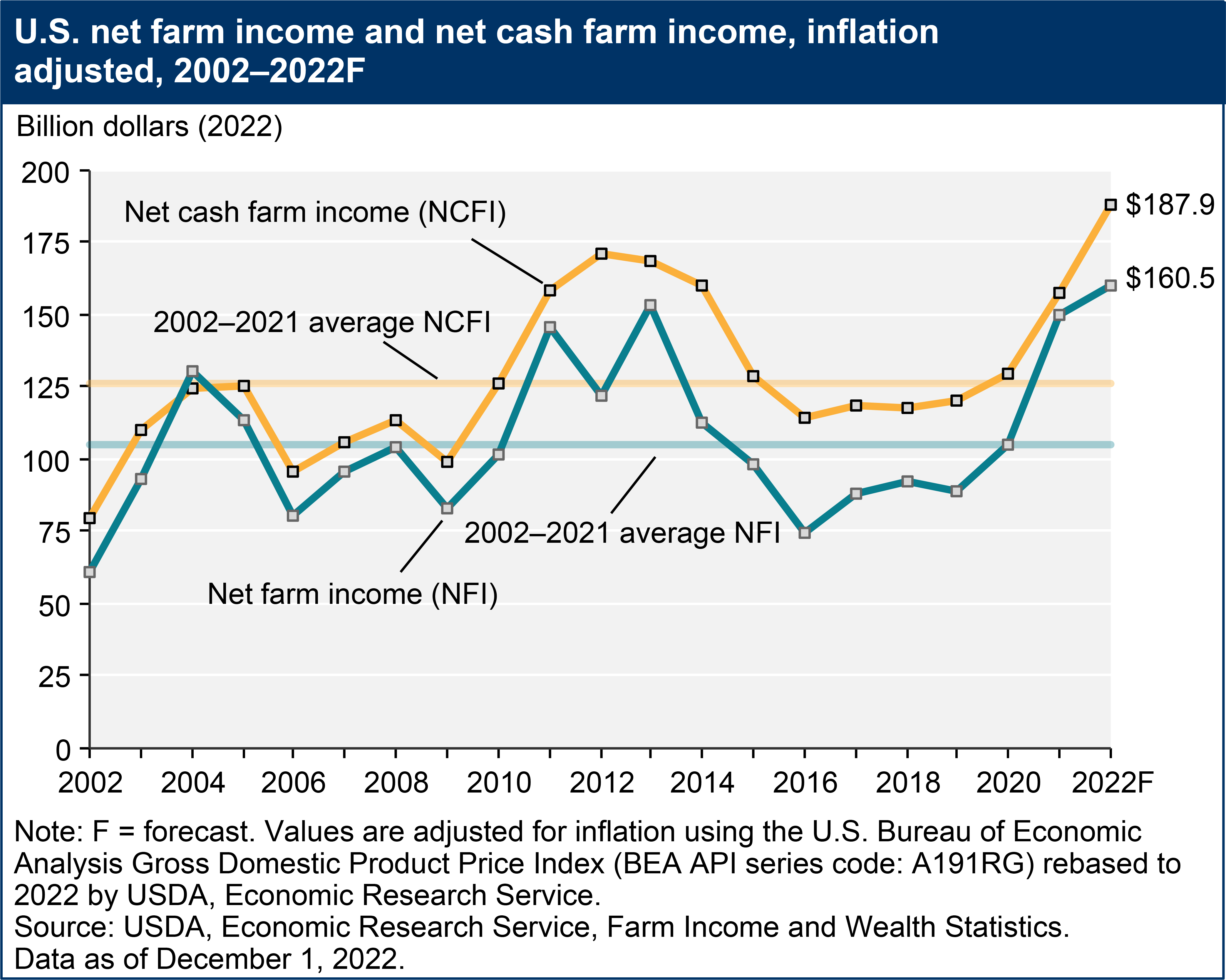

Adjusted for inflation, USDA reports both net cash and net farm income for 2022 will be at the highest level since 1973. Net cash is projected at $187.9 billion while net farm income is estimated to be 160.5 billion (see chart below). It is worth noting that net cash income includes all cash expenses while net farm income includes all cash and non-cash expenses, such as capital depreciation and farm household expenses.

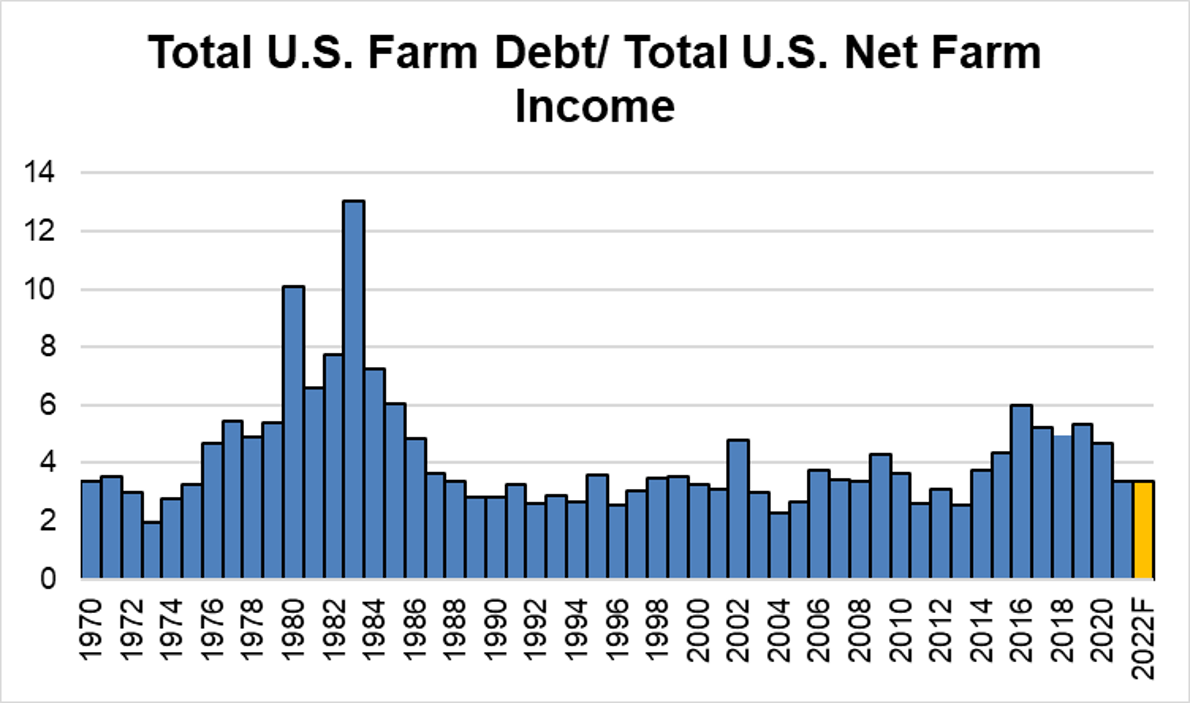

Net farm income is just one measure of the health of the agricultural industry. Other metrics, such as the value of agricultural production, farm debt, and land values, can also provide insight into the financial well-being of farmers and the agricultural sector as a whole. The publication Landowner by Farm Journal frequently reports on the ratio of Total U.S Farm Debt to Total U.S. Net Farm Income. When this ratio exceeds 4, it often indicates that stress is building within the U.S. agricultural sector. According to current projections, the ratio for 2022 will be 3.4. See chart below.

Looking ahead to the 2023 crop, farm income will likely be similar to 2022 and still above the historical average. Input prices, such as those for fertilizer and diesel, are expected to decrease slightly, though they will remain elevated. The ongoing Russian war in Ukraine will likely keep commodities prices firm including those for soybeans, wheat, rice, and corn. Cotton prices, on the other hand, appear to be heading lower. One of the biggest challenges facing U.S. agriculture is the impact of monetary policy and the impact of financing production and real estate. Commodity market demand is also a potential uncertainty, as disruptions in China due to the spread of Covid-19 or other global animal flu outbreaks could affect demand for agricultural products. Like every year, unknown and unforeseen factors will influence the market and certainly make the ending different than what was expected.