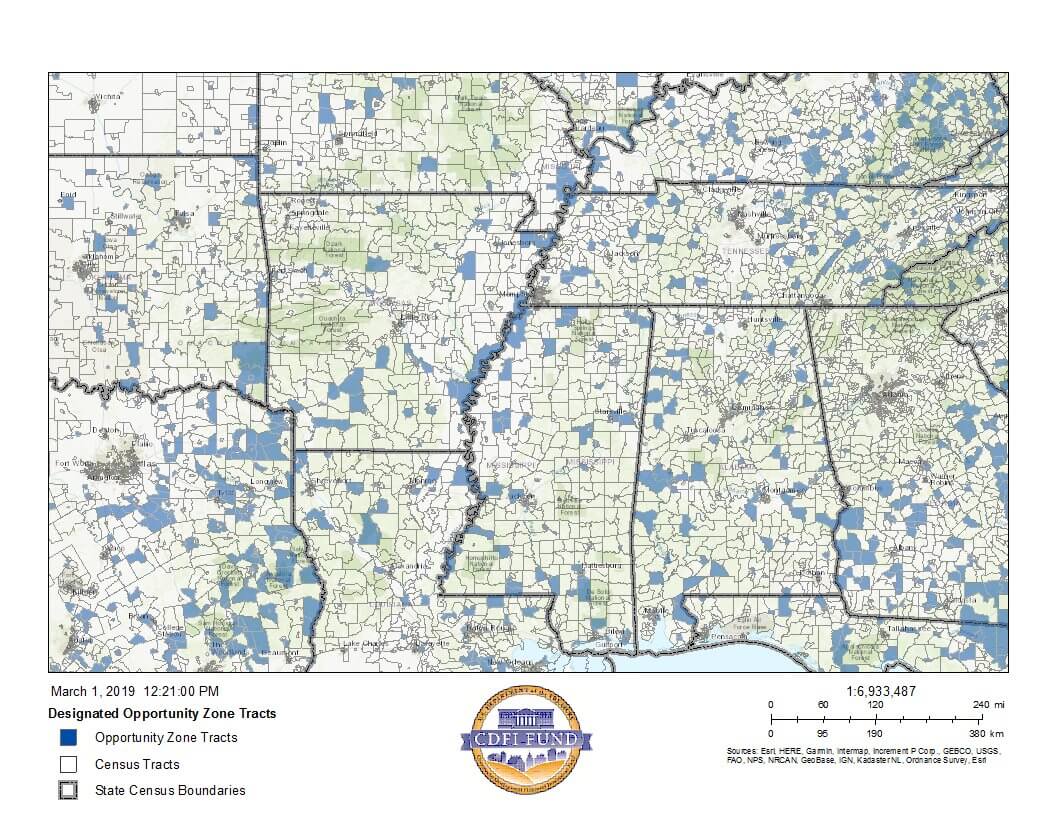

The 2017 Tax Cuts and Jobs Act established Qualified Opportunity Zones (QOZ) to encourage development and job growth in economically-distressed communities across the U.S. Many of these zones are located in the Mid-South and provide an opportunity to invest in real estate, including agricultural real estate. Once real property is purchased, requirements may include building new construction or “substantially improving” the property.

Investments in eligible properties can be made through Qualified Opportunity Funds (QOF). For a certified QOF, investors must be organized as a corporation or partnership for the purpose of investing in a QOZ property, qualify with the U.S. Treasury and hold at least 90% of their assets in the QOZ property. In addition, a QOF can only be an equity investment. Loans made to a QOZ are not eligible.

Several tax incentives are available through this program, most notably capital gains deferments. Capital gains reinvested into a QOZ within 180 days are tax-deferred for up to nine years. If the investment is held for five years, capital gains on the reinvested gains are reduced by 10%. If held for seven years, the reduction is increased to 15%. Additionally, any gains accrued after the investment into QOZ are tax-free if held longer than ten years.

More information—including a list of designated zones—can be found online at irs.gov. Please be aware that the above is merely an overview of the program. To acquire such a real estate investment, advice should be sought from legal and tax advisors.