Cropland Values Continue to Rise in the Mississippi Delta Region According to USDA

On August 4, 2011 USDA released its Land Values 2011 Summary and Cash Rents. The land values and cash rents are averages across an entire state. Since this is an average it is easy to find recent transactions that were lower or higher than what USDA shows. Although these are average land values, it does give us useful information about trends.

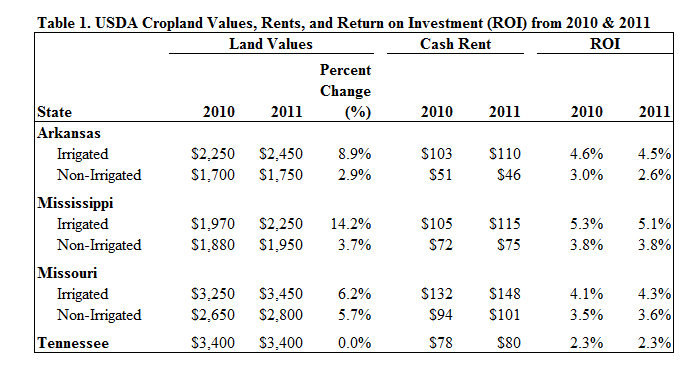

Table 1 presents the USDA cropland values, rents, and a calculated return on investment (ROI) for 2010 and 2011. ROI is calculated by dividing the cash rent by the land value. This information presented is for Arkansas, Mississippi, Missouri, and Tennessee. Cropland is also broken down between irrigated and non-irrigated for all states except Tennessee.

The USDA data highlights a few trends:

- The land value differential between irrigated and non-irrigated cropland continues to increase. For example, the difference between Arkansas irrigated and non-irrigated cropland in 2010 equaled $550/acre. In 2011 the difference increased to $700/acre! This price differential is also true with other improvements on cropland. Higher productivity generates larger rents and leads to increased cropland asset value.

- The return on investment continues to trend downward. It is impacted by the cost of borrowing money and alternative investments. Both of these are low in a historical perspective and are creating higher demand for productive cropland. At the same time productive cropland supply is limited. Supply and demand issues are pushing land values upwards and reducing the return on investment for cropland.

- Although, ROI is trending downward, cropland is still providing positive growth in land values and rent. Irrigated cropland values increased in the past year by 8.9%, 14.2%, and 6.2% in Arkansas, Mississippi, and Missouri, respectively. Historically, cropland has never been worth zero and continues to be an excellent alternative investment to stocks and bonds. I don’t see this trend changing any time soon.

By Jeffrey Hignight, Farm Manager and Associate Broker at Glaub Farm Management. Serving Landowners in Arkansas, Mississippi, Missouri, and Tennessee.